Berks County Pa Property Appraiser

Berks County - Assessment

Welcome To The Berks County Assessment Office Welcome To The Berks County Assessment Office Mission Statement The mission of the Real Estate Department is to maintain the quality of services that are offered to taxpayers, municipalities and school districts of Berks County.

https://www.berkspa.gov/departments/assessment

Berks County won’t raise property taxes despite shortfall • Spotlight PA

Update, Dec. 18: Berks County commissioners passed the 2026 budget with a revision that increases capital projects rolling over from 2025 by $15 million, for a total capital budget of $35 million. The full county budget rose to more than $690 million.

https://www.spotlightpa.org/berks/2025/11/berks-county-no-property-tax-increase-2026-budget-local-government/

Berks County PA Property Tax Assessment Appeals Guide 2026

When purchasing in late 2025, the first opportunity to appeal won't be until summer 2026 for 2027 taxes. The July 1-August 1 appeal window in Berks County is ...

https://mattsellsberks.com/blog/Berks-County-PA-Property-Tax-Assessment-Appeals-GuideBerks County adopts 2026 budget with no tax increase

– As promised when the 2026 budget was presented in November, the Berks County Commissioners voted Thursday to adopt a $690 million spending ...

https://www.wfmz.com/news/area/berks/berks-county-adopts-2026-budget-with-no-tax-increase/article_a541cea9-2c22-4c33-a85b-50d27b546429.htmlBerks County 2026 Proposed Budget

As a result, we propose the real estate tax rate remain unchanged for 2026 at 9.013 mills. We believe the proposed budget enables us to maintain ...

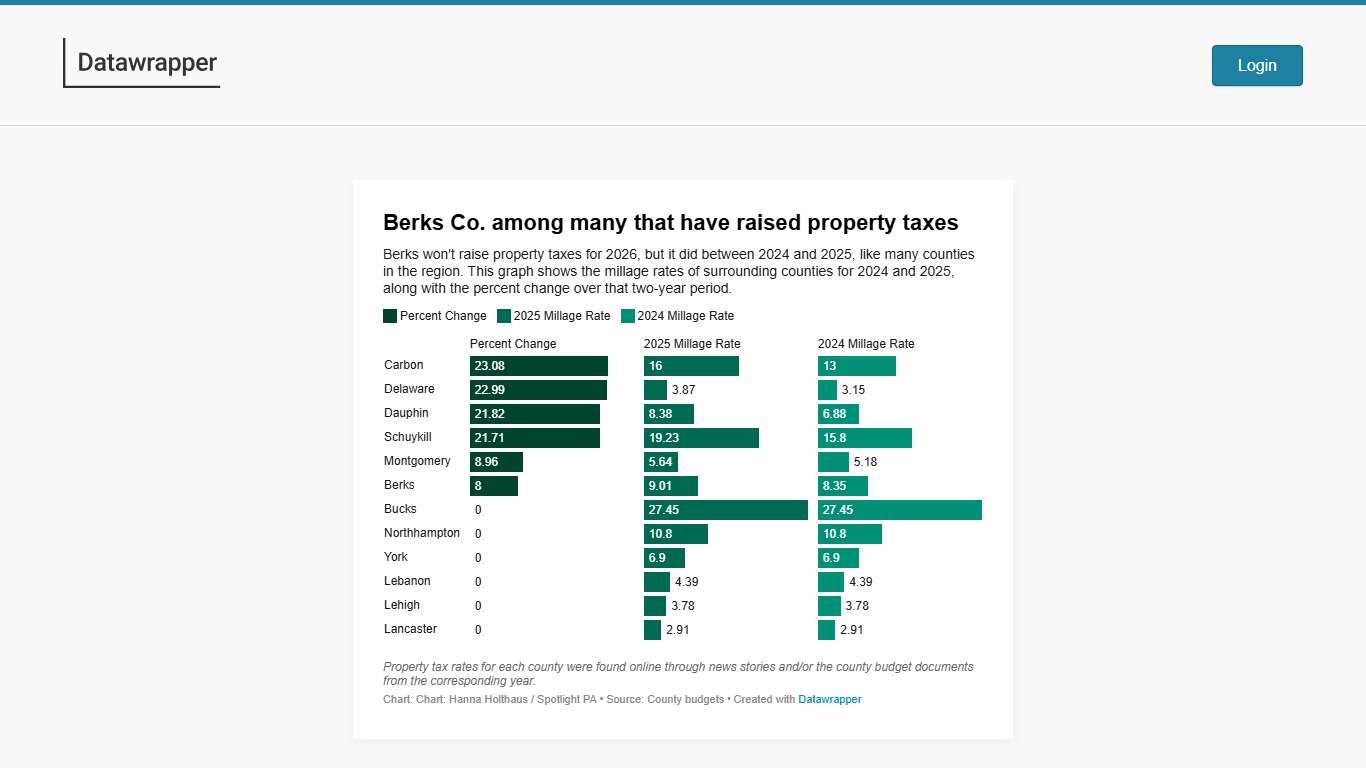

https://www.berkspa.gov/getmedia/bf9d2387-7cec-4e45-8a45-30196fcce2a3/2026-Proposed-Budget-Message.pdfBerks Co. among many that have raised property taxes Created with Datawrapper

With Datawrapper, you can create visualizations like the one above in minutes instead of hours! It's free to use and no sign-in is needed to try it out yourself.

https://www.datawrapper.de/_/Kyl1R

WFMZ - As promised when the 2026 budget was presented in... Facebook

As promised when the 2026 budget was presented in November, the Berks County Commissioners voted Thursday to adopt a $690 million spending plan with no tax increase. It’s about time these slugs do something. Let’s not forget that in 23 there was an 8% increase and all management took an average of 13% raises.

https://www.facebook.com/69WFMZ/posts/as-promised-when-the-2026-budget-was-presented-in-november-the-berks-county-comm/1304352868401208/

Reading, PA, property tax increase proposed for 2026 budget • Spotlight PA

This story has been updated to reflect a proposed tax rate of 19.761 mils, which would result in a 9% property tax increase. The City of Reading’s original budget presentation and budget booklet incorrectly listed the proposed millage rate as 19.261 because it did not include the shade tree and library millage funds.

https://www.spotlightpa.org/berks/2025/10/reading-pennsylvania-property-tax-increase-2026-budget-local-government/

CitizenPortal.ai - for Informed Citizens

Citizen Portal News From Official Government Sources Article Type Location Article Type Location February 04, 2026|Prince George's County, Maryland|01:02:30 Maryland legislative leaders and the state comptroller told the county council that the state faces a roughly $1.4 billion shortfall, federal job losses are reducing county revenues, and priorities this session include affordability, Medicaid protections, energy costs and targeted supports...

https://citizenportal.ai/articles/7017855/Berks-County/Pennsylvania/Berks-County-proposes-balanced-2026-budget-with-no-tax-increase-commissioners-advance-draft

Reading looks to raise property taxes, dip into reserve funds to break even

This story was produced by the Berks County Bureau of Spotlight PA, an independent, nonpartisan newsroom. Sign up for Good Day, Berks, a daily dose of essential local stories at spotlightpa.org/newsletters/gooddayberks. READING — City of Reading landowners may see a 6% increase on their property tax bill next year, but the extra revenue may not be enough to keep the city from dipping into its reserve funds to cover 2026...

https://berksweekly.com/news/reading-looks-to-raise-property-taxes-dip-into-reserve-funds-to-break-even/

CitizenPortal.ai - for Informed Citizens

Citizen Portal News From Official Government Sources Article Type Location Article Type Location February 04, 2026|Prince George's County, Maryland|01:02:30 Maryland legislative leaders and the state comptroller told the county council that the state faces a roughly $1.4 billion shortfall, federal job losses are reducing county revenues, and priorities this session include affordability, Medicaid protections, energy costs and targeted supports...

https://citizenportal.ai/articles/7017855/Berks-County/Pennsylvania/Berks-County-proposes-balanced-2026-budget-with-no-tax-increase-commissioners-advance-draft

Property Tax/Rent Rebate Program Department of Revenue Commonwealth of Pennsylvania

2025 Property Tax/Rent Rebate Season Now Open The Department of Revenue's Property Tax/Rent Rebate program application period is now open. The department is now accepting applications for rebates on property taxes or rent paid in 2025. Eligible Pennsylvanians are encouraged to file their applications online through myPATH to ensure their rebates are processed as quickly as possible.

https://www.pa.gov/agencies/revenue/ptrr

Reading, PA Property Tax Calculator 2025-2026

Calculate Your Reading Property Taxes Reading Tax Information Reading is located in Berks County, PA. Property taxes are determined by the county tax rate and your home's assessed value. Berks County median Berks County rate Berks County median Property Taxes in Reading Property taxes in Reading, PA are assessed and collected by Berks County.

https://propertytaxescalculator.com/pennsylvania/reading

Happy New Year, 124th! Now that 2026 is here, I want to look back at what we were able to accomplish in 2025. On this edition of Barton Breaks It Down, I’ll recap some of the work done by my District Office team, events we hosted and funding we managed to bring back for projects in the district. PA State Rep. Jamie Barton Facebook

Ron Snell Have you called PA State Rep. Wendy Fink or Senator Dawn Keefer to request a School Property Tax Elimination Town Hall meeting in your district? It is information that your constituents would love to hear. In Pa. more than 10,000 people every year lose… See more...

https://www.facebook.com/RepBarton/videos/happy-new-year-124th-now-that-2026-is-here-i-want-to-look-back-at-what-we-were-a/1433490585045736/

Hereford, Berks County, Pennsylvania Property Taxes - Ownwell

Hereford, Berks County, Pennsylvania Property Taxes Median Hereford, PA effective property tax rate: 1.05%, significantly higher than the national median of 1.02%, and lower than the Pennsylvania state median of 2.75%. Median Hereford, PA home value: $22,300 Median annual Hereford, PA tax bill: $234, $2,166 lower than the national median property tax bill of $2,400.

https://www.ownwell.com/trends/pennsylvania/berks-county/hereford